As interest rates declined in late 2023, there was a general sense of optimism that the apartment market would show significant improvement in 2024. At the halfway point of 2024, apartment market fundamentals (rents/vacancies) are stabilizing or improving, though the sales market remains extremely sluggish.

We have created a one page report summarizing how the Portland apartment is faring in YTD 2024. While the sales market remains depressed, apartment fundamentals will likely see continued improvement based on very little proposed construction. Apartment sales picked up in the second quarter of 2024 and buyers/sellers appear to have accepted that lower prices seen recently are not transitory. Keep in mind that not all submarkets are equal, with certain areas faring better than others.

The Barry Apartment Report - Summer 2023

As we near the mid-point of 2023, the Portland apartment market has shifted dramatically from 2022 which was a record breaking year on many levels. In the first half of 2023 we’ve seen apartment fundamentals return to a more balanced market, though the sales market has ground to a halt.

Full Report Here

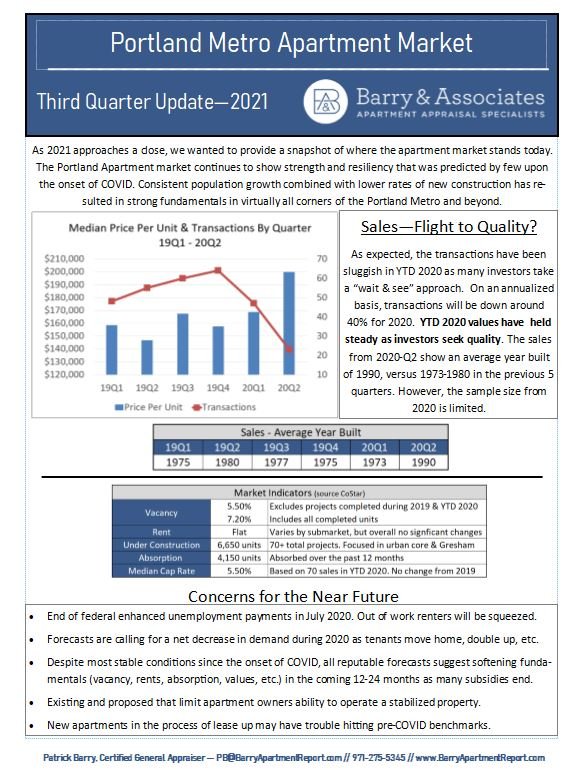

Market Update - Late 2021

As 2021 approaches a close, we wanted to provide a snapshot of where the apartment market stands today. The Portland Apartment market continues to show strength and resiliency that was predicted by few upon the onset of COVID. Consistent population growth combined with lower rates of new construction has resulted in strong fundamentals in virtually all corners of the Portland Metro and beyond. The report can be found here.

Portland Apartment Market ‐ Shifting fundamentals

The Portland Metro apartment market has shown a robust recovery over the past 6 months. However, some recent data and forecasts are a bit concerning.

Vacancies are forecast to decline over the next three years, returning to 2013‐2016 levels

Year over year rents are forecast to increases around 4.0 to 9.0 percent over the next three years

Number of units under construction has dropped from a high of around 12,500 in 2018 to 4,000 as of YTD 2021. Future development levels are uncertain.

Portland Metro population growth forecast to increase and return to 2012‐2013 levels in the coming years

2021 Portland Apartment Market Forecast: Strong Economic Recovery Expected After a Dark Year

We recently completed our annual Portland Apartment Newsletter. It provides a wrap up of the apartment market in 2020 and a forecast for 2021. The full report is here, but I've summarized a few main points below.

Market Highlights

Overall, median prices were up in 2020 though there was an obvious flight to quality with fewer sales of higher risk properties.

Suburban areas saw rents that increased slightly and stable vacancies

Urban areas experienced some rent declines and increased vacancies

Forecasts for strong rent increases in 2021 and 2022

Apartment permits down in Portland, but steady outside of Portland

While many are experiencing economic uncertainty, there are many well capitalized investors seeking multifamily properties.

$800 million in Q4 2020 apartment sales confirms Portland’s national investment appeal

Risks

Apartment completions will likely outpace demand in 2021

Shift toward home ownership and home construction

Increased regulation is making investors/developers consider locations outside OR

Slower population growth and aging cohort of prime renters; Oregon in 2020 had slightly more deaths than births for the first time ever

Reputational damage in Portland from negative national publicity

Some clear signs of increasing interest rates as of March 2021

If any questions ever come up, please don't hesitate to reach out.

2020 Summary & 2021 Forecast

We recently presented to CCIM and provided our summary of 2020 and forecast for 2021. While the future forecasts are mixed, it is agreed upon that the apartment in 2020 fared better than just about anyone expected.

Is Apartment Construction Headed to the Suburbs?

During 2020, the percentage of Portland Metro multifamily permit applications increased in the suburban area. However, this is a result of a dramatic decline of Multnomah County permit applications, which dropped from 5,165 units in 2019 to 2,043 in 2020. Washington, Clark, and Clackamas County represented 64 percent of all permit applications in 2020, though the total number of units applied for remains unchanged from 2019.

Tax Changes - Real Life Example

In November 2020, a slew of new taxes were approved by Portland residents. Up until now, I had not seen any examples of how this could impact owners and investors. This recent analysis from Bluestone & Hockley, Moss Adams, and the KBR Law Group provides a few hypotheticals and how an owner could be impacted. I highly recommend taking the time to read through the article.

https://www.bluestonehockley.com/2021-portland-tax-changes/

Multifamily NW Fall 2020 Report

2021 Maximum Rent Increase Announced

The cap on rental increases for 2021 will be 9.2 percent.

Portland Apartment Market Update & COVID

Portland Metro Apartment Market - Mid-Year Update—2020

ULI Real Estate Economic Forecast

ULI has released their Spring Real Estate Forecast which concludes that the impact of COVID-19 on the commercial real estate market will be less severe than the Great Recession. The 39 economists/analysts at 35 leading real estate organizations suggest that conditions will improve after 2021.

ULI Real Estate Economic Forecast

Multifamily Highlights (National)

Cap Rates: Up 40 basis points in 2020 & 2021 before dropping 20 basis points in 2022

Vacancies: Up 100 basis points in 2020, flat in 2021, and dropping by 40 basis points in 2022

Rents: Down 2.0% in 2020, up 2.0% in 2021, and up 3.0% in 2022

June 2020 Revenue Forecast

Lots of useful and current information here.

Economic and revenue forecast slide presentation

Economic and revenue forecasts

Portland Apartment Sales - COVID Impact

It’s no surprise, but early indicators show that apartment transactions in Portland Metro will be down in 2020. Sales from January through March are typical of recent years, but only 7 transactions for April (reported so far) likely represents the beginning of slower sales.

There is no clear road map for the year ahead as we are in unprecedented times. To get an idea of how the Portland apartment sales market reacted to previous shocks to the system, we looked back at sales before/after the events of September 11th and the start of The Great Recession. There are major differences with our situation today, but this provides some insights.

The tables below summarize the number of transactions and sales volume in the year before and after these major events. We excluded the three months immediately following each event as sales were limited and the sales that did occur were in contract prior.

Multifamily NW Survey Results & Impact of COVID-19 on Apartment Development

We recently wrote an article for Multifamily NW regarding Portland Apartment construction. The article includes the latest construction figures and the results of a developer survey about apartment construction in the midst of COVID-19.

Portland Metro Apartment Market – Review of 2019 & Thoughts for 2020 and 2021

On March 4, 2020, we presented to CCIM. The presentation summarized the market for 2019 and also provided some forecasts for the coming years. The full slide deck is available from the link below.

Portland Metro Apartment Market – Review of 2019 & Thoughts for 2020 and 2021

Oregon Tax Inequities

Oregon’s property tax inequities have existed for years, though I still get surprised. These two properties sold for the same price per unit in September 2019. However, the apartment in NW Portland has per unit property taxes and a per unit assessed value that is 78% above the property in close-in SE Portland.

Are Portland renters finally getting a break because of higher apartment vacancies?

Portland Apartment Market - 2019 Summary

With the vast majority of 2019 sales accounted for, we created a quick one page report summarizing how the Portland apartment market fared. All in all, it was a decent year and may finally represent a shift back to a more stable ("normal") market